how to get cheaper car insurance in 2023

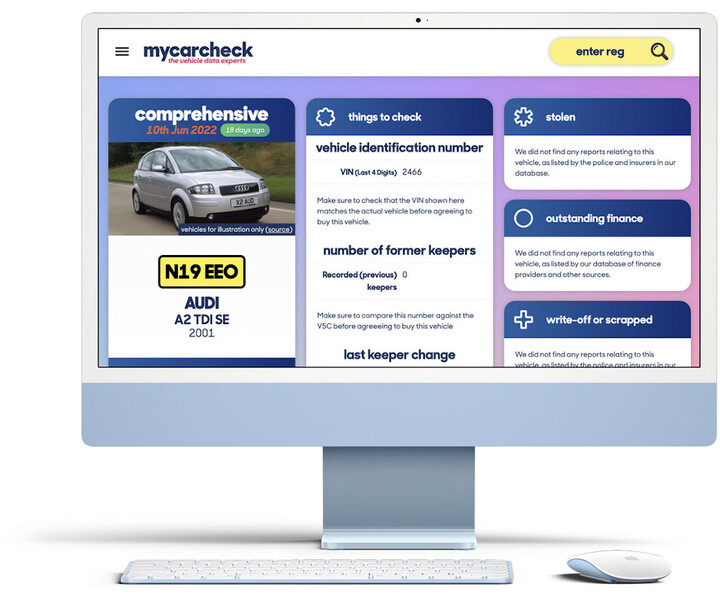

FREE Car History Check

See MOT history, valuations, detailed specs and more… AND upgrade to see if any vehicle has been stolen, has finance or has been written off from just £4.99

Cheaper car insurance is something everyone wants, particularly when costs are running high across many other areas of our lives. Although it might seem like the only way to keep things cheaper is to cut out often vital cover, there are ways you can stay protected for less.

Can you get just third party insurance?

Third party cover is the legal minimum level of protection you need in the UK, and it covers damage done to the other car if you are in a collision. However, for many people, third party doesn't cover a wide enough range of situations.

Some people choose to opt for the next level up: third party, fire, and theft. This form of insurance provides compensation if your car is stolen or destroyed by fire.

However, opting for third party, fire and theft won’t provide you with any cover if you are involved in an accident that was your fault – so bear this in mind when considering how much protection you will require.

Is it cheaper to get breakdown cover separately?

Breakdown cover is a great way to pay for peace of mind when it comes to roadside assistance – and can be a lot cheaper than buying the full package from an insurance provider. Many providers offer good deals on breakdown cover independently, so you should shop around before deciding which option is best for you.

This usually comes as part of a comprehensive policy, which will also include cover for damage done to your own vehicle, among other things. It is the most wide-ranging type of car insurance, covering a number of risks.

What is the cheapest UK car insurance group?

The cheapest car insurance group in the UK is Group 1. This group covers cars with small, low-powered engines and basic safety equipment. These are often the cheapest cars to insure on a comprehensive policy, although they will be more expensive if you only want third party cover.

Makes and models in this group include:

- Volkswagen Up!

- Fiat Panda

- Toyota Aygo

- Seat Mii

- Renault Twingo

How can I get the cheapest car insurance in the UK?

The best way to get the cheapest car insurance in the UK is by shopping around and comparing quotes from different providers. It’s important to consider all the factors that can affect the cost of your policy – such as where you live, how old the car is, and any other drivers on your policy.

You could also reduce your premiums by adding a named driver to your policy, increasing the excess on your policy, or opting for third party only cover if you don’t need full comprehensive protection.

Another option is telematics insurance, which involves fitting a device in your car that tracks how you drive. If you stay within the speed limit, don’t make sudden stops or take sharp turns, and stick to driving during daylight hours, then this can help lower the cost of your policy.

Finally, if you are looking at buying a new car, research insurance groups before you make your purchase. The car you choose can have a big impact on the cost of your insurance policy.

How can you lower insurance after an accident?

After an accident, it’s important to shop around to get the best deal on car insurance. Many providers will increase premiums following a claim, but there may be other options available for you.

Firstly, look at insurers who specialise in offering competitive rates for drivers with recent claims – these can often be cheaper than going back to your previous insurer.

You could also consider increasing the excess on your policy, which can help lower premiums. Just make sure you are comfortable with the amount of money you’d need to pay if you ever need to make a claim – it may be worth getting a quote from a few insurers before deciding on an excess amount.

Are there any other ways to keep car insurance premiums down?

Some other useful tips include:

-

Look at the excess levels

The excess is the amount you pay out if you need to make a claim. Higher excesses mean lower premiums and vice versa. Carefully consider how much of an initial payment you can afford before selecting your level of voluntary excess; that way, should anything happen, you won’t be stuck with a hefty bill for something you can’t afford.

-

Pay annually

Rather than paying for your premiums monthly, pay annually instead; this will often reduce the cost of your overall premium in one lump sum.

-

Make sure you shop around

The best way to find a good deal on car insurance is to look at different providers and compare the policies and prices they offer. Doing your research thoroughly can save you a lot of money in the long run, so it pays to be thorough.

Doing all of these things can help ensure that you get the best deal possible on your policy, so you can keep premiums down and enjoy the peace of mind that comes with knowing that your car is properly covered.