the FCA ends price walking

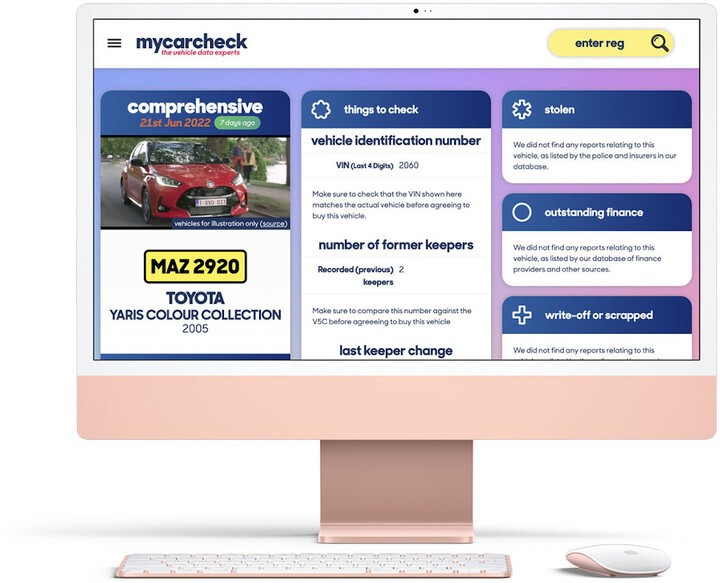

FREE Car History Check

See MOT history, valuations, detailed specs and more… AND upgrade to see if any vehicle has been stolen, has finance or has been written off from just £4.99

2022 will hail the end of the unfair practice of price walking. Many insurance companies have withheld the best offers for new customers, which leaves loyal customers in the dark.

The FCA is banning companies from raising rates on current customers more than they raise rates on new customers. They are also planning to prohibit companies from cancelling policies or refusing to renew policies for arbitrary reasons. These new rules would help to ensure that customers are treated fairly and that they can keep their insurance policy without fear of being taken advantage of.

What is price walking and why is it bad?

Price walking is the practice of increasing rates on current customers more than they increase rates on new customers. This can leave loyal customers in the poor position of not getting the best deals available.

Price walking is bad for a few reasons. First, it’s unfair to customers who have been loyal to a company. These customers are essentially being punished for not shopping around.

Second, price walking can lead to higher premiums for everyone. When companies increase rates on current customers more than they increase rates on new customers, it drives up the cost of insurance for everyone. This is because the new customers are paying the increased rates, but the old customers are still paying the old rates. This drives up the average rate and makes it harder for people to afford insurance.

Insurance companies have been known to use price walking as a way to increase profits. By hiking rates for those who have been with them for a while, they can make more money without actually attracting new customers.

The loyalty penalty, as it's also known, is going to be disappearing in the UK this year. The FCA has put in place new rules which state that insurance companies can no longer increase premiums for those who have been with them for a while more than they increase them for new customers.

So, what can you do to avoid being a victim of price walking?

There are a few things you can do to avoid being a victim of price walking. First, shop around and compare rates. This will ensure that you are getting the best deal possible.

Second, stay loyal to your insurance company. If you have been with them for a while, don’t be afraid to ask for a rate increase. They may not give you what you want, but it never hurts to ask.

Finally, voice your concerns. If you feel like your insurance company is increasing rates unfairly, let them know. The more people who speak up, the more likely it is that something will be done about it.

Why does my car insurance keep changing?

Car insurance premiums change all the time due the the way in which certain risk factors are assessed by insurers.

These "risk factors" include the number of accidents, car thefts and car break-ins; who drives your car; where you drive it; how old it is; its engine size and value. In addition to this, recent changes in legislation - such as the introduction of the Continuous Insurance Enforcement (CIE) scheme in 2011 - have also affected premiums.

The CIE scheme means that all vehicles must be insured at all times, even if they are only being used for a short journey or are off-the-road. This increases the number of insured vehicles and, as a result, the overall cost of car insurance.

Why is my car insurance increasing every year?

This is due to a number of factors including increased traffic volumes, an increase in careless driving and the increasing cost of repairing modern vehicles. Car insurance costs also depend on your job, where you live and how many years of driving experience you have under your belt. Drivers with a poor claims history can also expect to see their premiums rise.

However, when the new rules come into place, you might end up with a better deal by sticking with your chosen insurer a bit longer. So, before you switch to a new provider, be sure to compare rates and see if you can save money.

What should I do if my car insurance goes up?

If your car insurance premium is increasing, there are a few things you can do to try and save money:

- Shop around: compare prices from a range of different insurers to find the best deal for you

- Increase your excess: this is the amount you have to pay towards a claim, so increasing it could bring down your premium

- Add an extra driver: sharing the cost of insurance with someone else can make it more affordable

- Go for a lower level of cover: if you don't need comprehensive cover, consider opting for third party only or third party, fire and theft

- Renew your policy before the increase comes into effect: this will lock in your current premium price for another year.

Get a check with mycarcheck to see the full history of the car you want, so you can buy with confidence every time.